For Fintech

Hyperproof for Fintech: Streamline GRC Workflows and Save Valuable Time

Identify compliance gaps related to FINRA and adapt to evolving regulations while minimizing manual work for evidence collection and audit readiness, all within Hyperproof.

Trusted by

![]()

“Hyperproof demonstrated a commitment to improving the platform to support the FFIEC’s frameworks, which is a huge advantage for us.”

Camille Terhune

Senior Information Security Analyst //

OnPoint Community Credit Union

Meet regulatory expectations for your

fintech organization with Hyperproof

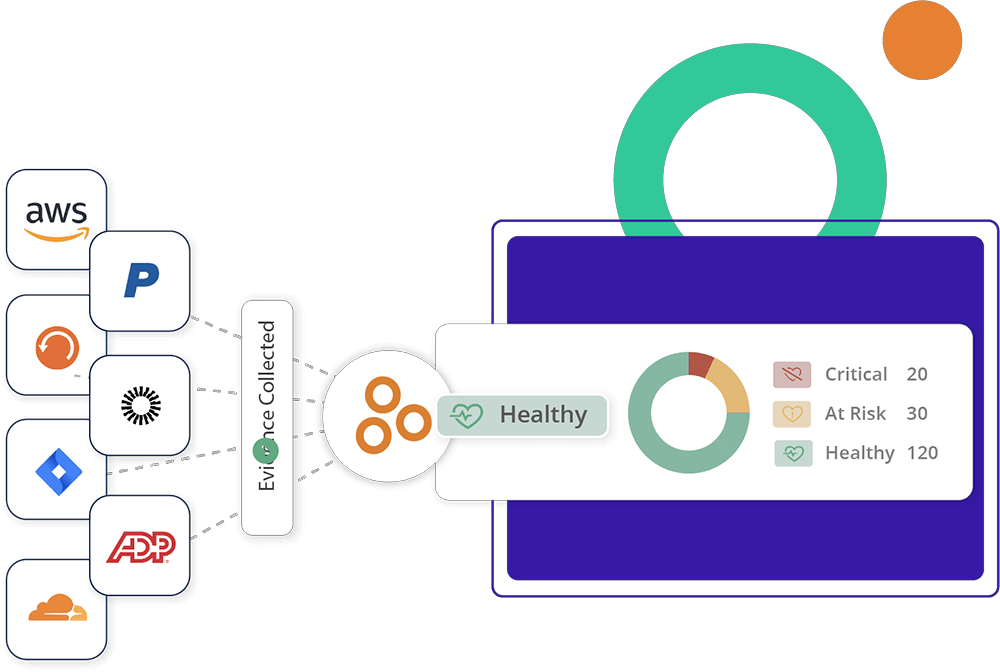

Simplify evidence gathering and automate label creation

Automatically collect and associate evidence with relevant controls and requirements. Generate labels, apply them to proof items, and refresh evidence either in real time or on a set schedule.

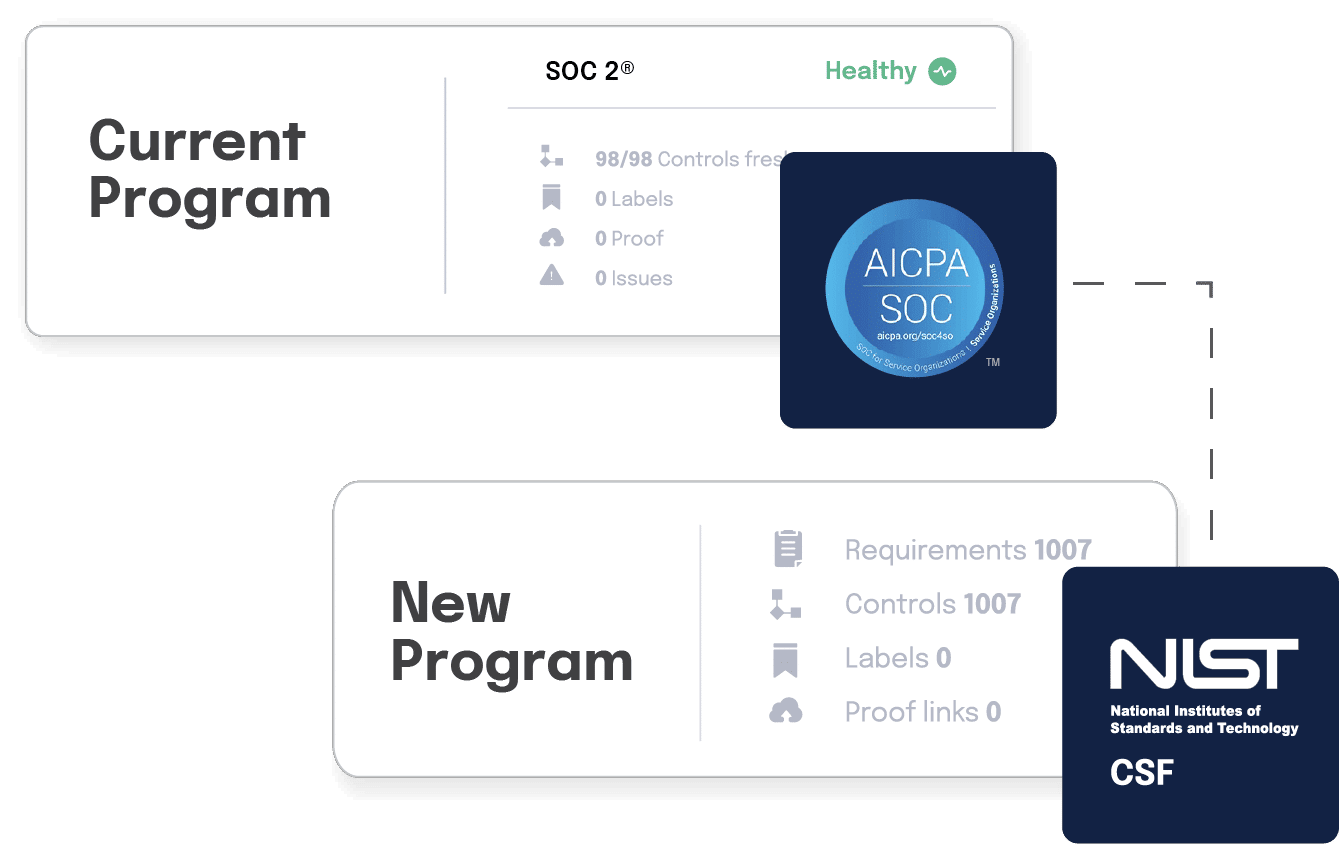

Test controls automatically and map them across frameworks

Use existing controls to meet the requirements of multiple frameworks such as FFIEC, NIST CSF, NIST 800-53, SOC 2, PCI DSS, GLBA, CCPA, ISO 27001, and GDPR. Continuously evaluate control performance and trigger follow-up tasks based on test results.

Track and manage risk across your business

Use Hyperproof’s built-in risk register to log, monitor, and report on risks. Generate live dashboards and reports to inform leadership and demonstrate compliance health.

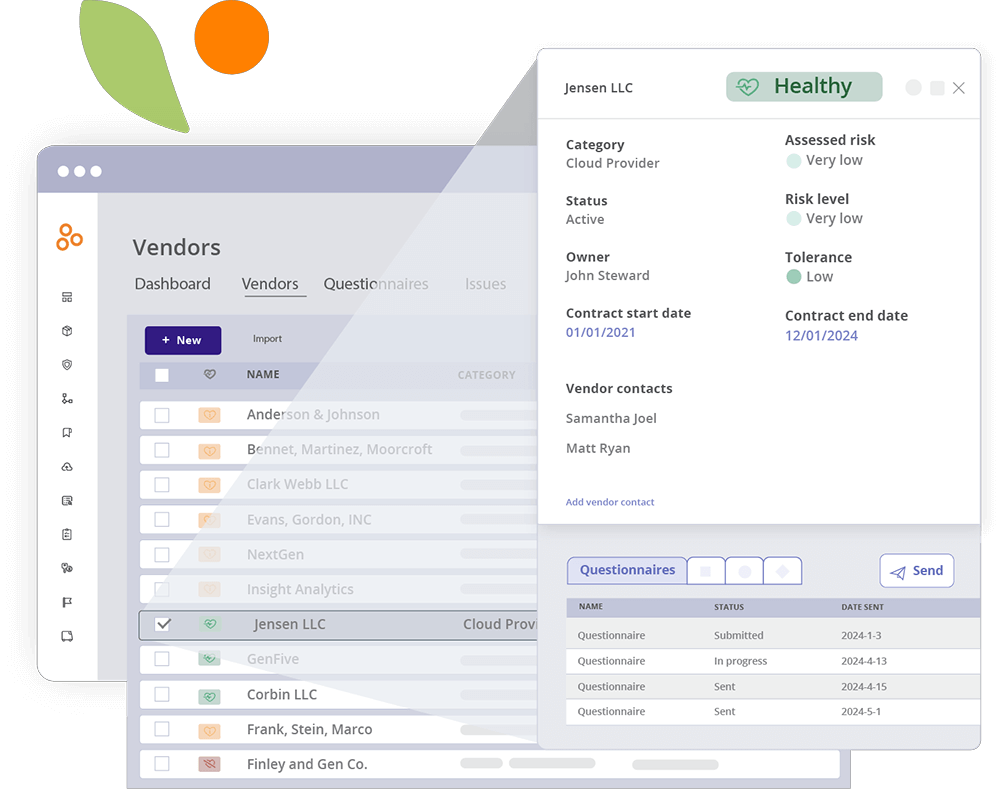

Consolidate vendor risk processes in one platform

Evaluate third-party risk using automated assessments. Manage vendor reviews, contracts, and remediation workflows efficiently from a single centralized space.

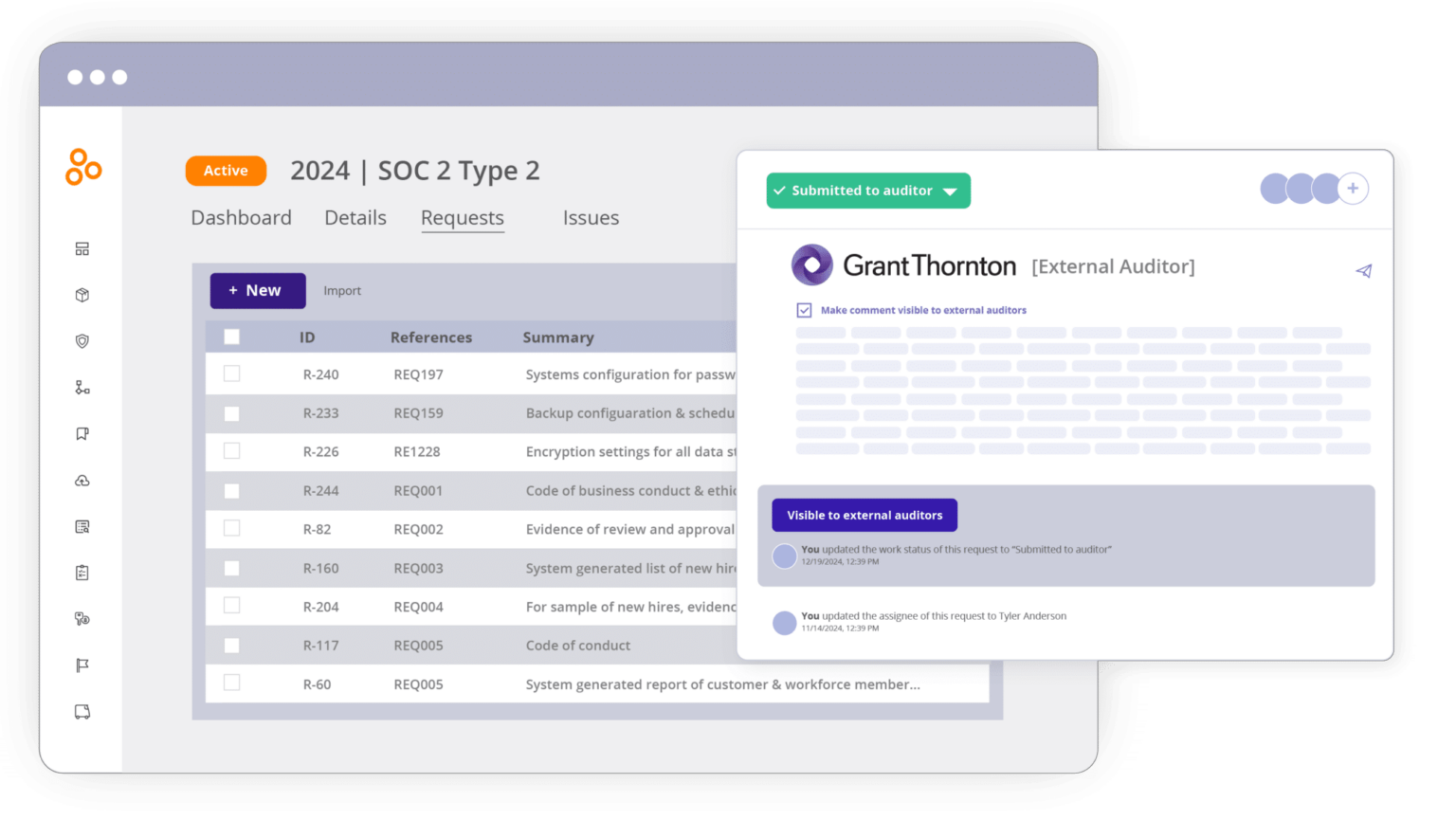

Collaborate with auditors in a dedicated environment

Invite auditors into a secure, purpose-built workspace in Hyperproof to share only the data they need—making audits smoother and more transparent for everyone involved.

Why Hyperproof?

The industry’s most extensive framework library

Seamless integrations that reduce manual effort